Super Update – November 2023

Special Super Contributions

As mentioned in our August Super Update there are some special types of super contributions that you may be able to take advantage of.

- Spouse contributions

- The receiving spouse must be under age 75 and be eligible to make non-concessional (after tax) contributions,

- The non-concessional contribution cap applies,

- The Total Super Balance restrictions apply,

- If the receiving spouse’s assessable income plus reportable fringe benefits plus reportable super contributions for the year is below $40,000, the individual making the contribution may be eligible to claim a tax offset of up to a maximum of $540.

- Downsizer Contributions

- Eligible homeowners aged 55+ may contribute up to $300,000 each following the sale of their primary residence, where the home was held for more than 10 years,

- There is no upper age limit,

- This contribution is not counted towards your non-concessional contribution cap,

- The Total Super Balance restrictions do not apply,

- Strict time and administration requirements must be met for making the payment into super,

- This contribution opportunity may only be used once.

- Capital Gains Tax (CGT) Small Business Concessions

- Individuals up to age 75 may contribute certain proceeds from the sale of assets used in a small business,

- Lifetime CGT caps apply,

- The Total Super Balance restrictions do not apply,

- Strict time and administration requirements must be met,

- These provisions are complex and specialist tax advice should be obtained.

- Government Co-contribution

- Individuals under age 71 at the end of the income year, with income* under $58,445 may be eligible to receive a co-contribution from the Government,

- More than 10% of the individual’s income must be from employment or self-employment,

- The individual must make a non-concessional contribution to super,

- The Government will contribute $0.50 cents for every dollar the individual contributes up to a maximum of $500 if income is below $43,445,

- The co-contribution phases out completely when income* exceeds $58,445.

* Income includes assessable income + reportable fringe benefits + reportable super contributions – assessable first home super saver payments – available business deductions.

- Carry Forward Contributions

- From 1 July 2018 any unused concessional contribution cap may be carried forward for up to 5 years,

- Individuals who have a Total Super Balance of less than $500,000 on the 30 June may carry forward their unused cap and use it in the next year,

- Unused caps carried forward and not used within 5 years will expire.

Please contact us if you would like further information about any of the above or to check your eligibility prior to making the contribution.

Age Pension Payment Rates and Eligibility

The Australian Government’s Age Pension is designed to provide income support for eligible older Australians and is indexed twice a year in March and September. Eligibility is assessed based on your age, residency status and both income and assets.

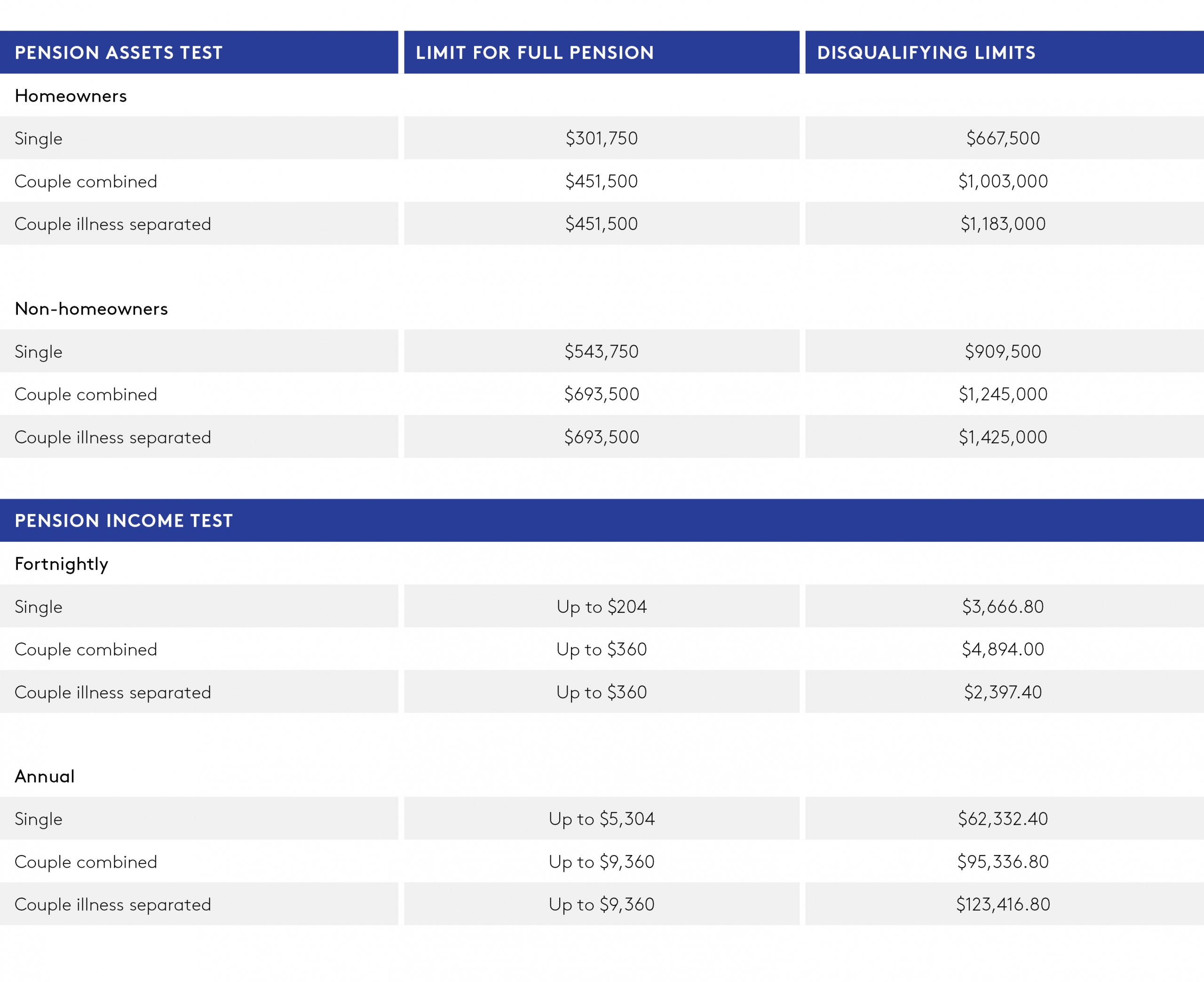

- New income and asset cut-offs following the September 2023 indexation are shown in the following table:

Over time your eligibility for the Government Age Pension may change. Also, because of the higher level of inflation being experienced now, the eligibility limits have changed considerably.

Over time your eligibility for the Government Age Pension may change. Also, because of the higher level of inflation being experienced now, the eligibility limits have changed considerably.

If you would like to speak to one of our advisers to discuss your specific circumstances and eligibility, please contact us.

Proposed tax on Super Balances over $3m (Division 296 tax)

On 3 October 2023 draft legislation and explanatory materials were released by the Government for public consultation.

The legislation is essentially unchanged from the original announcement and will apply from 1 July 2025. It will impose an additional 15% tax on a member’s ‘taxable superannuation earnings’ where their total super balance is above $3m.

Points to note are:

- There is no indexation of the $3m cap

- Taxable Superannuation Earnings includes unrealised gains

- The ATO will do all the calculations

- The additional tax will be charged to the individual

- The individual can elect to pay the tax from super

Lobbying and consultation continues and we will keep you informed when this new tax becomes law.

If you think you may be affected by this new tax and would like to quantify the impact on you or discuss this, please contact us. (refer to our original article on March 8 – Labor’s Proposal to increase Tax Rates for Super Balances Above $3million for more details)

Proposed Objective of Super

On 16 November a bill was introduced into Parliament to legislate the objective of super.

“To preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”

Setting this objective for superannuation will ensure that all future changes to the superannuation system are compatible with the main objective of super and is designed to keep retirement as the focus.