Super Update: Concessional Contribution Cap Increase

In this Superannuation Update, we highlight the changes to the concessional contributions caps, property investment options available to SMSF’s and an update on the proposed taxes on super balances over $3m.

1. Change in the Concessional Contribution Cap for the 2025 financial year

Additional concessional contributions reduce your taxable income either through salary sacrifice or by claiming a personal tax deduction. These contributions are subject to annual caps and represent a significant opportunity to reduce tax and provide for your future.

The contribution cap is indexed to average weekly ordinary time earnings (AWOTE) each financial year but as it only increases in increments of $2,500 it doesn’t always increase every year.

The 6 monthly AWOTE rate was released on 22 February and results in the concessional contribution cap increasing to $30,000 for the 2025 financial year.

The change in this cap also flows through to the following for 2025:

- Non-concessional cap – increases from $110,000 to $120,000

- Non-concessional bring forward maximum – increases from $330,000 to $360,000

No Change to Transfer Balance Cap from 1 July 2024

The General Transfer Balance Cap (TBC), which dictates how much super can be moved to the retirement phase, is indexed in line with the consumer price index (CPI) movement from December to December each year.

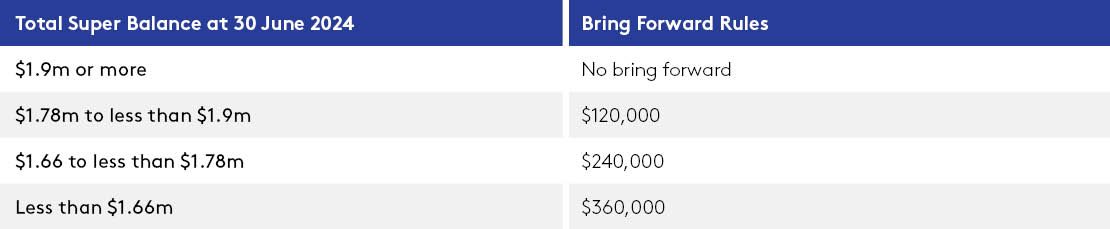

The CPI increase in December 2023 was not sufficient to lift the TBC so the Transfer Balance Cap will remain at $1.9 million for the 2025 year.

See the table below for the impact this and the increased concessional contribution cap has on the non-concessional contribution bring forward rules.

2. Property Investment Options available to SMSFs

One of the major benefits of having an SMSF is the ability to invest directly in property, either residential or commercial.

There are several different ways this can be achieved.

- Buy it straight out,

- Buy with another party as Tenants in Common,

- Buy using a Limited Recourse Borrowing Arrangement (LRBA),

- Buy units in a Unit Trust that owns the property.

There are pros and cons of all these options and a number of superannuation rules and regulations need to be followed. We’ve seen some excellent results where commercial property is owned by an SMSF and is being leased back to the member’s business.

If you’d like to know more about the options available, please contact our Super Team or our Wealth Advisory team and they will be able to explore the options with you.

3. Progress of Legislation:

Proposed tax on Super Balances over $3m (Division 296 tax)

The bill was introduced to the House of Representatives on 30 November 2023 and was referred to a Senate Economics Committee on 7 December 2023. This committee is expected to report back by 19 April 2024. Details of how defined benefit interests will be valued have not yet been released.

The Government hopes to have this passed before 30 June so that individuals have a full year to prepare for the start date on 1 July 2025. Lobbying continues and amendments may still be made. See the November Super Update for full details of how this new tax works.