Any announcement of proposed changes to superannuation rules naturally results in anxiety for most investors.

Whilst Labor’s recent announcement of a proposed higher rate of tax on super balances above $3m, from 1 July 2025, has caused quite a stir, our view is:

- The proposed changes will not negatively impact most superannuation members given the high balance threshold;

- For those members with projected large balances, i.e. $3m+ including pension accounts, there will be some planning strategies to consider; and

- Superannuation continues to be an attractive environment for investors and retirees. Below the $3m threshold, tax on earnings in accumulation accounts remains 15%, while tax on pension accounts is still 0%. For many who have super balances above the $3m mark, the 30% tax rate on above threshold earnings may also continue to be relatively attractive.

What do we know about the proposal thus far?

The Government has announced that tax concessions provided to individuals who have a total super balance over $3m will be reduced.

- Only individuals with total super balances (TSB) over $3m will be affected (TSB includes pension accounts)

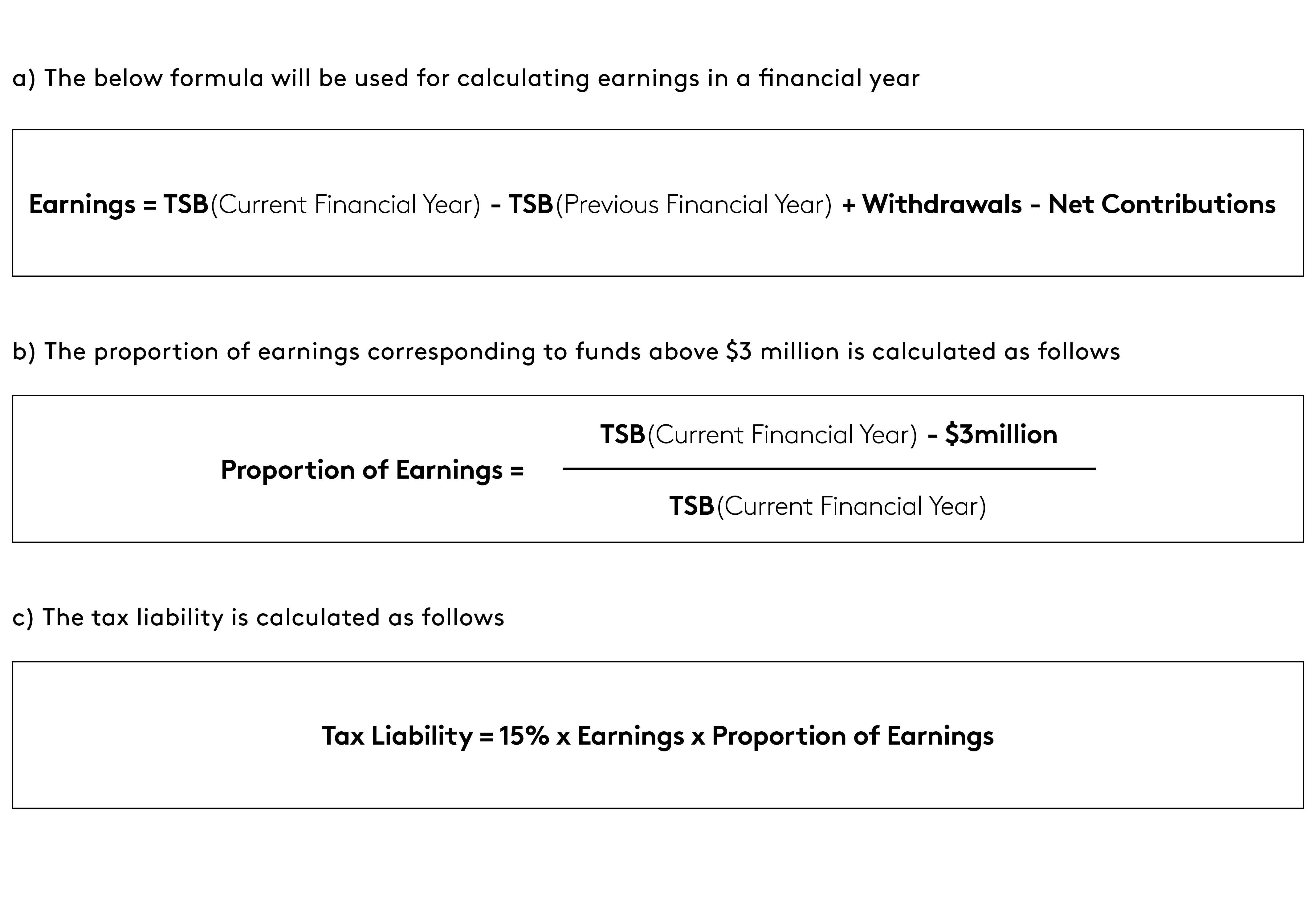

- An additional 15% tax will be payable by individuals on earnings for the proportion of the super balance that is above $3m

- The calculation method for earnings is shown below and is based on the move in market value of investments. Losses in a particular year will be carried forward and offset future gains.

- The change will commence from 1 July 2025 (it is not retrospective).

- Amounts over $3m do not need to be withdrawn from super

- The $3m will not be indexed (thus long term superannuaion investment planning is required)

- There will be no change to how the super fund is taxed

- The Australian Taxation Office will administer the process using the information that is already reported to them by super funds

- The additional tax will be levied on the individual and will be able to be paid out of pocket or from super

- How earnings will be calculated for individuals in a defined benefit fund is yet to be determined

Calculation Method

This Factsheet issued by the Government provides some detailed examples.

The current announcement is only a proposal at this stage. The proposal firstly needs to go through the rigor of targeted consultation, plus a range of official parliamentary processes before it makes it into legislation. If passed into law, it will not come into effect until July 2025.

As a super fund member, should I worry?

Given the relatively high balance threshold before the higher tax rate kicks in, even if this legislation does pass, superannuation will continue to be one of the most tax-effective structures for retirement investment savings.

Further, no proposed changes have been made to the tax-free status of eligible superannuation withdrawals from age 60, or the ability to withdraw your funds from super once you have triggered a condition of release. This provides opportunity for those clients where the threshold becomes a concern to implement smart super strategy planning.

A number of proactive planning strategies may become even more important such as super-splitting, recontribution strategies or withdrawing funds from super to stay under the proposed threshold with the view to investing in other non-super tax-efficient structures.

Our recommendation

If you would like to take a more proactive approach to your superannuation investment and wealth planning, we offer an initial complementary whiteboard strategy session to explore your options and value creation potential.

Contact one of our wealth management experts on: contact@sawarddawson.com.au or 03 9894 2500.

Mark La Bozzetta

Partner – Strategy and Wealth Advisory

Marie Ickeringill

Director – Self Managed Superannuation