Federal Budget – March 2022

Last night the 2022-23 Federal Budget was released. The main focus of this year’s budget is to outline the various ways to deal with the current costs of living pressures that Australians currently face. If there is something in the budget that impacts you, our team would be happy to discuss this with you.

Please select any of the following topics to read more…

Business

Skills and Training Boost

From 7.30 pm on 29 March 2022 until 30 June 2024, small businesses with an aggregated turnover of less than $50 million will be able to deduct an extra 20% of expenditure incurred on external training courses provided to employees in Australia or online. The external training courses must be delivered by entities registered in Australia. Costs associated with training for non-employees (such as a partner in a business partnership) are ineligible.

Technology Investment Boost

From 7.30 pm on 29 March 2022 until 30 June 2023, small businesses with an aggregated turnover of less than $50 million will be able to deduct an extra 20 per cent of expenditure up to $100,000 worth of business expenses and depreciating assets that support their digital adoption such as portal payment devices, cyber security systems, or subscriptions to cloud-based services.

Automated Reporting of Taxable Payments

Currently, many businesses are required to report payments made to contractors on a Taxable Payments Annual Report (TPAR) by 28 August after the end of financial year. From 1 January 2024, businesses will be able to report on the same lodgement cycle as their activity statements.

Sharing of Single Touch Payroll Data

The Government will commit $6.6 million in funding to develop the IT infrastructure which enables the Taxation Office to share the Single Touch Payroll data to the relevant state and territory revenue offices to allow streamlining of the payroll tax compliance process.

Improved PAYG System

The government announced that from 1 January 2024 companies will be able to choose to have their PAYG instalments calculated based on current financial performance rather than past income tax returns.

Additionally, the gross domestic product (GDP) uplift factor has been set at 2% instead of at the default rate of 10%, resulting in lower PAYG instalments for eligible taxpayers for the 2022-23 financial year. The lower uplift factor will provide cash flow support to small businesses, including sole traders, and individuals with investment income.

Expanding the Patent Box Regime

The government will expand the patent box regime from only applying to medical and biotechnology industries (as announced in the 2021-22 budget and currently before parliament), to the agricultural sector as well as to low emissions technology innovations. Income derived from Australian-owned and developed patents within these areas will be taxed at a concessional rate of 17%.

The regime will apply from 1 July 2022 for the medical and biotechnology patent sectors, and the expanded application to agricultural and low emissions technology innovations will only commence from 1 July 2023.

Support for Apprentices

From 1 July 2022, apprentices will receive $5,000 in direct cash payments over their first two years while up to $15,000 of wage subsidies will be provided to employers who take on new apprentices from a “priority” list. A once-off payment of $3,500 will be provided to employers who take on new apprentices from a “non-priority” list.

After two years from July 2024, wage subsidies will be replaced with a $4,000 hiring incentive for employers and $3,000 for apprentices only if they are on the priority list.

FBT exemption for COVID-19 Tests

Individuals will be able to claim a tax deduction for the cost of COVID-19 tests required to attend a place of work from 1 July 2021. As a result of this, the cost of these tests will be exempt from fringe benefits tax (FBT) where they are provided by employers.

Not For Profits

Government Funding

The 2022 Federal Budget provided little for the majority of the not-for-profit sector. Some areas that will receive additional funding are aged care quality and safety, pharmacy services for residential aged care facilities, and mental health. However there has been some criticism for the lack of any significant funding for climate change initiatives and foreign aid. The spending on foreign aid will fluctuate each year but will decline significantly in real terms over the next four years.

Community Foundations

Up to 28 community foundations that are affiliated with Community Foundations Australia will be specifically listed as deductible gift recipients (DGR) from 1 July 2022 to 30 June 2027. Their governing rules must prohibit the use of funds beyond that permitted for entities endorsed under the DGR categories in the tax law. These funds will need to maintain minimum annual distributions similar to the current requirements for ancillary funds.

Tax

2022-23 Federal Budget – Impact on Individuals

The government has introduced several initiatives in the 2022-23 federal budget that are designed to benefit individuals.

Cost of Living Relief

The buzzwords for the 2022 budget were ‘cost of living relief’, with a number of initiatives announced to ease the pressures associated with the rapidly increasing cost of living caused by COVID-19, natural disasters and international pressures.

One off Low-and Middle-Income Tax Offset (LMITO) Increase

An additional $420 will be added to the LMITO offset for the 2021-22 financial year. This means that low-and-middle-income earning individuals will receive the benefit of up to $1,500 (previously it was $1,080) with their 2022 income tax return and couples up to $3,000.

The new maximum LMITO amounts are set out in the table below:

| Taxable Income | Maximum Payment | Increase |

| Up to $37,000 | $675 | $420 |

| $37,000 – $48,000 | $675 plus 7.5% of the amount of income over $37,000 | $420 |

| $48,000 – $90,000 | $1,500 (the new maximum offset) | $420 |

| $90,000 – $126,000 | $1,500 less 3 cents for every dollar above $90,000, capped at $420 | $420 |

| $126,000 or more | $0 | $0 |

The LMITO will be received on assessment after the individual lodges their tax return for the 2021-22 year.

Notably, the government did not announce an extension to the LMITO, which is scheduled to cease at the end of the 2022 financial year with the increased payment. However, an extension has not been ruled out and has occurred in the past.

Cost of Living Payment to Social Security Recipients

A $250 payment will be made in April 2022 to individuals who are currently in receipt of an Australian government allowance or pension to ease the pressure associated with the rising cost of living. The payment is only available to Australian residents and is exempt from income tax.

The payment will be made available to those that receive the age pension, disability support pension, parenting or carer payments, carer allowance (if not in receipt of a primary income support payment), Jobseeker payment, youth allowance, Austudy or Abstudy allowance, double orphan pension, special benefit, farm household allowance and some Veterans’ Affairs payments. People who hold a Pensioner Concession Card, Commonwealth Seniors Health Card or Veteran Gold card will also receive the payment.

Individuals will only receive one payment, regardless of the number of pensions or allowances they regularly receive.

Decreased Fuel Excise

A temporary 50% reduction to fuel excise will be in place for 6 months from 12:01am on 30 March 2022 to 11:59pm on 28 September 2022.

The reduction will reduce the excise from 44.2 cents per litre to 22.1 cents per litre and is estimated to save a family with two cars up to $700 over the 6-month period. The excise reduction applies to both petrol and diesel.

Deductibility of COVID-19 Tests

Individuals can claim a tax deduction for the cost of COVID-19 tests required to attend a place of work from 1 July 2021. This deduction includes the cost of both Polymerase Chain Reaction (PCR) Tests and Rapid Antigen Tests (RATs).

Tests taken for purposes outside of attending a place of work will not be deductible.

Superannuation

As expected, the superannuation guarantee rate will increase from 10% to 10.5% from 1 July 2022 for all individuals. The superannuation guarantee rate will continue to increase by 0.5% each year until it reaches 12.0% from 1 July 2025.

The concessional contributions cap will remain at $27,500 for the 2022-23 year for all individuals. This means that the maximum tax-deductible contribution that can be made before extra charges are levied is $27,500.

Families, Health and Aged care

Enhanced Paid Parental Leave

The current Parental Leave Payment (18 weeks paid leave for the primary carer) and the Dad and Partner leave payment (2 weeks paid leave) will be combined under a new Paid Parental Leave Scheme which will allow eligible working families to access up to 20 weeks of leave that can be used in ways that suit their circumstances. Leave will be fully flexible and both parents can decide how to best split their 20 weeks of paid leave between themselves.

The income test will be broadened to a threshold of $350,000 in family household income (currently the income threshold of $151,350 applies to the mother only).

The Paid Parental Leave can be taken at any time within two years of the birth or adoption of the child.

An additional two weeks of Paid Parental Leave will also be made available to eligible single parents, meaning they can now access the full 20 weeks available to couples.

COVID-19 Response Package – Aged Care

The government has announced that an additional $458.1 million in funding will be allocated to the Aged Care sector over the next five years to manage the impact of COVID-19. This includes the provision of bonuses of up to $800 to aged care workers in residential aged care and home care over two years from 2021-22.

Funding for the Aged Care Preparedness program will also be extended and expanded in 2022-23 with the goal of managing and preventing outbreaks of COVID-10 and preparing providers with the transition to living with COVID-19.

The capacity for vaccination services and PCR testing for both residents and staff will also be targeted in the short term.

Pharmaceutical Benefits Scheme – Lowering the Safety Net Threshold

From 1 July 2022, the Pharmaceutical Benefits Scheme (PBS) Safety Net Threshold will be reduced, allowing patients to reach the safety net sooner. It is estimated that concessional patients will require 12 fewer scripts, and general patients two fewer scripts, before the safety net is reached.

Once the PBS safety net has been reached, concessional patients receive PBS medicines for free for the rest of the calendar year and general patients receive their PBS medicines at a reduced rate; currently $6.80 per prescription.

Housing

Home Guarantee Scheme

The government will provide an additional $8.6 million to expand the Home Guarantee Scheme, increasing the number of places to 50,000 per year for three years from 2022-23 and then 35,000 per year thereafter. The Home Guarantee Scheme allows eligible homebuyers to purchase a home with a deposit of less than the 20% that is normally required without needing to pay lender’s mortgage insurance.

The scheme has been specifically expanded to allow more first home buyers, families and people wishing to live in regional areas to participate.

The scheme can be used together with other government initiatives, such as the First Home Super Saver Scheme, HomeBuilder grant or State and Territory First Home Owner Grants, and stamp duty concessions.

Aged Care

The sector was hoping for ongoing job security through budget funded wage increases given the significant toll the pandemic has taken on workers; however, many are disappointed with the latest announcements.

The 2022-23 budget will see an additional $468 million for the aged care industry, but this is still less than the amount needed to implement recommendations from the Aged Care Royal Commission.

Key Budget Measures

$210 million to support the aged care workforce – up to $800 bonus to be paid in 2 installments to workers who were actively employed on 28 February, and again 28 April 2022. This is similar to the workforce retention bonus paid earlier in the pandemic as an initiative to keep workers in the industry.

$345 million over 4 years to improve medication management through embedding pharmacy services on-site in residential aged care facilities, or improve community pharmacy services.

$49.5 million to subsidise up to 15,000 vocational education and training places as a measure to encourage new workers into the industry.

A further 40,000 home care packages will be made available to allow Australians to receive care and support in their own homes.

$20.1 million further funding to the AN-ACC transition fund to provide a smooth transition from the old AFCI model to the AN-ACC model commencing from 1 October 2022. This brings the total transition fund commitment to $73.4 million.

Superannuation

Prior to the budget announcement, Josh Frydenberg announced that the Government would extend the 50% reduction to minimum pension drawdown requirements for another year. He also pledged that there will be no increased superannuation taxes during their next term.

Extension of Reduction in Super Drawdown

The temporary 50% reduction in the superannuation drawdown rate has been extended for another 12 months until June 2023. This will provide retirees more flexibility to cope with the volatility in investment markets.

As a result of this change the rates that apply for the years ended 30 June 2022 and 30 June 2023 are:

| Age | Normal Percentage | 2022 and 2023 Reduced Percentage due to COVID-19 |

| Under 65 | 4% | 2% |

| 65-74 | 5% | 2.5% |

| 75-79 | 6% | 3% |

| 80-84 | 7% | 3.5% |

| 85-89 | 9% | 4.5% |

| 90-95 | 11% | 5.5% |

| 95 or greater | 14% | 7% |

A number of the changes announced in last year’s budget have now been passed into law. See our summary below:

Recently the Government passed The Treasury Laws Amendment (Enhancing Superannuation Outcomes For Australians and Helping Australian Businesses Invest) Bill 2021.

Some of these changes provide significant opportunities to grow your superannuation.

The Bill implements most of the superannuation changes proposed in the 2021-22 Federal Budget as detailed below:

Changes to the work test requirements for those aged 67 to 74

The current work test rules require an individual aged 67 to 74 to be gainfully employed for at least 40 hours in a period of 30 consecutive days, during the income year.

From 1 July 2022, the work test will be removed for these individuals in relation to non-concessional (after tax) contributions and salary sacrifice contributions. The work test will continue to apply to personal concessional (deductible) contributions.

Increasing access to the bring-forward rule from 67 to 74

The cut-off age for the bring-forward rule in relation to non-concessional contributions has been increased from 67 to 75.

From 1 July 2022 individuals who are under age 75 at the start of the financial year will be able to trigger the bring-forward rule, allowing them to make non-concessional contributions of up to $330,000 in one year.

The existing total super balance requirements that limit or remove access to the bring-forward rules continue to apply.

Lowering the age for downsizer contributions from 65 to 60

From 1 July 2022, the minimum age to make a downsizer contribution will reduce from 65 to 60. The maximum contribution, under these rules remains $300,000 per couple and all other rules remain the same.

The eligibility age is tested at the time the contribution is made to the super fund and not the time the house is sold (contract date).

Giving some SMSFs choice of Exempt Current Pension Income (ECPI) Method used

Superannuation funds, with periods solely in pension phase, for part of the year will be able to choose their preferred method to calculate ECPI. The choice is only available where no member has a total super balance over $1.6m at 30 June of the prior year.

Removal of the $450 monthly income threshold for employer superannuation guarantee support

Currently employers are required to pay superannuation guarantee (SG) only to employees who earn over $450 in salary or wages in a calendar month.

For SG quarters commencing 1 July 2022, the minimum SG threshold will be removed and an employer will also be required to pay SG on earnings less than $450 in a calendar month.

Increasing the maximum releasable amount for the First Home Super Saver Scheme

The maximum amount of voluntary contributions an individual can release under the First Home Super Saver Scheme will increase from $30,000 to $50,000 from 1 July 2022.

There is no change to the annual voluntary contribution limit, which will remain at $15,000. This means that contributions will need to be made over at least four years to take maximum advantage of the scheme.

Disability

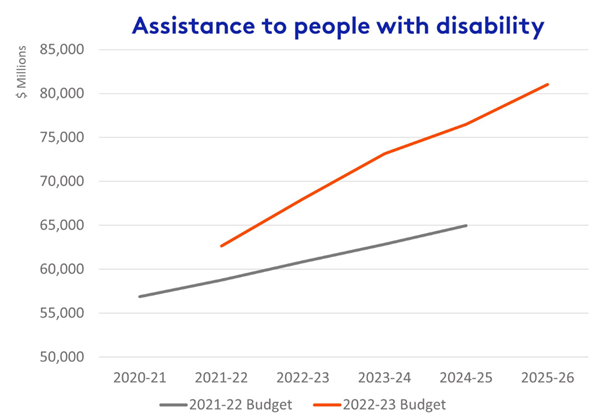

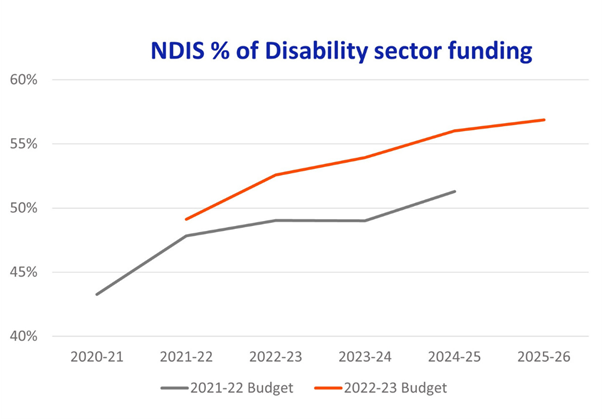

The NDIS and the disability sector as a whole continue to be a key program expense for the Government, with the Government reiterating that the NDIS will continue to be fully funded.

NDIS funding is budgeted to swell significantly over the next four years, and is expected to exceed defence spending in 2024-25. While overall funding is increasing, this is because more people are expected to enter the scheme rather than real growth in the NDIS average plan size per participant.

Significant increase in funding for the sector has been announced. An additional $29 billion from 2022-23 to 2024-25 is budgeted for assistance to people with disabilities. Funding in this sector which includes the NDIS scheme, disability pension, and financial support for carers is expected to increase by 9.6 per cent in real terms between 2022-23 and 2025-26.

The increase is largely driven by the rising number of people with disability projected to enter the NDIS over the next four years and growing individual support costs.

Other funding announced for the sector include:

- $249.1 million to be invested in increasing the quality, skills, size and attractiveness of the broader care and support workforce

- $44.6 million over 2 years from 2022-23 to continue support for businesses who employ mature-aged Disability Employment Services program participants through the Restart Wage Subsidy