Last night the Labor Government delivered its first budget since coming to office. Not surprisingly, the overall economic outlook makes for sobering reading with inflation pressures, resource and labor constraints and ongoing budget deficits forecast.

Please select any of the following topics to read more…

Business

Depreciation

Self-assessing the effective life of intangible assets

The Government will not proceed with the measure to allow taxpayers to self-assess the effective life of intangible assets such as patents, registered designs, copyrights, and in-house software that was announced in the 2021-22 Budget. This means effective lives of intangible assets will continue to be set by statute.

Temporary Full Expensing

The temporary expensing rule allows businesses with an aggregated turnover of less than $5 billion to deduct the full cost of eligible depreciating assets in the year they are ready for use. No announcement has been made in relation to extending the temporary full expensing of depreciating assets beyond 30 June 2023. This also means that, in the absence of any further announcement, the instant asset write-off threshold for simplified depreciation for small businesses will revert to $1,000 after 30 June 2023.

Electric Car Discount

The government reiterated its intention to provide a fringe benefits tax (FBT) exemption for electric cars and a tariff reduction by finalising legislation that was introduced into parliament in July 2022.

The proposed legislation will mean that a battery electric, hydrogen fuel cell electric and plug-in hybrid electric car will be exempt from FBT if its cost was below the luxury car threshold for fuel-efficient cars (currently $84,916) at the time it was sold.

The proposed measure only applies to electric cars that were first held and used on or after 1 July 2022. The car can be second hand, but an employer will need to find information in relation to its first retail sale to ensure it is eligible.

Although an electric car can be exempt from FBT, it will still give rise to a reportable fringe benefit amount. The proposed FBT exemption is intended to be reviewed after three years.

The provision of a car as a fringe benefit to an employee involves consideration of various issues and can be complicated. We recommend that you contact us to discuss this so that any proposed salary packaging arrangements are implemented correctly.

Small Business Supports

The government has announced funding will be available from 1 January 2023 over two calendar years to support small businesses. The Small Business Debt Helpline and the NewAccess for Small Business Owners program will be extended to support the financial and mental wellbeing of small business owners.

Energy Efficiency Grants for Small Medium Enterprises (SMEs)

The government will provide $62.6 million over 3 years from 2022-23 to small and medium-sized businesses to fund energy efficient equipment upgrades. This grant will cover feasibility studies, planning measures along with equipment and facility upgrades designed to improve efficiency or lower emissions.

Digital Currencies

The government announced that it will introduce legislation to clarify that digital currencies continue to be excluded from the Australian tax treatment of foreign currency and will continue to be subject to capital gains tax treatment when held as an investment.

Limit on Cash Payments to Businesses – not proceeding

A proposed law that was announced in the 2018-19 Budget to impose a limit of $10,000 for cash payments made to businesses for goods and services will not be proceeding.

Multinationals

Cross border intangible payments to low-cost (or no-cost) tax jurisdiction denied

The Government will introduce an anti-avoidance measure to deny payments to related parties that hold intangibles in a low or no cost tax jurisdiction. For the purpose of this measure, a low or no tax jurisdiction is one with a tax rate of less than 15%. The denial of deduction reduces the effectiveness of utilising a low tax jurisdiction to hold intangibles. This will apply for income years commencing from 1 July 2023.

Significant global entities and public companies will have additional reporting requirements

Currently, all significant global entities (SGEs) are required to lodge a country by country report with the ATO. The measure will now also require public disclosure of certain information; including a statement regarding the entities’ approach to taxation. In addition, Australian public companies (listed or unlisted) will be required to disclose the number of subsidiaries and their country of tax domicile. Further, any tenderers for Australian government contracts that are worth more than $200,000 are required to disclose the ultimate head entity’s country of tax residence. This will apply for income years commencing from 1 July 2023.

Amendment to thin capitalisation rules for non-ADIs

The Government will strengthen its thin capitalisation rules to address the risks from the use of excessive debt deductions. The safe harbour test (i.e. debt to asset ratio) will be replaced by a new earnings-based test for non-authorised deposit-taking institution (ADI). The earnings-based test will limit the relevant entities’ debt deductions to 30% of profit (i.e. using earnings before interest, taxes, depreciation and amortisation (EBITDA) as the measure of profit). For any debt deductions denied (i.e. as it exceeded the 30% EBITDA ratio), then it may be carried forward and claimed up to 15 years. This will apply for income years commencing from 1 July 2023.

Not For Profits

Government Funding

The Federal Budget shows a greater focus on climate change issues, with increased funding for clean energy innovation and biodiversity protection. The government will also fund various initiatives to support women’s safety. However, there is minimal additional funding for the majority of the arts sector. On a positive note, the government has pledged additional assistance to Ukraine and an increase in aid to the Pacific and Southeast Asia.

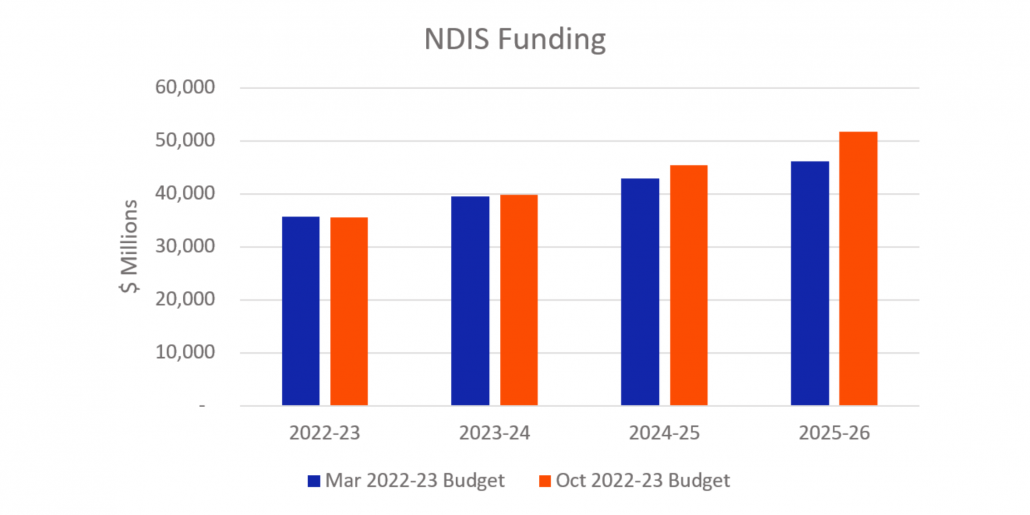

NDIS Review

The government will establish a review of the NDIS to look at the scheme’s design, operation and sustainability. The NDIA will receive $385 million over the next two years and employ 380 more staff. The government will also establish a cross-agency Fraud Fusion Taskforce to reduce fraud and non-compliance with the program. The NDIS is now second only to the age pension as the most expensive government social program. More information can be found under the ‘Disability’ sector in this article.

Aged Care

Funding for aged care includes an additional $1.4 billion for various measures. More information can be found under the ‘Aged Care’ sector in this article.

DGR Pastoral Care

The previous government proposed to establish a new deductible gift recipient category for providers of pastoral care and well-being services in Australian schools. Unfortunately, the Government has announced it will not proceed with this measure.

Tax

2022/2023 Federal Budget – Impact on Individuals

The Government has not introduced any new individual tax measures. The focus of this Budget was towards the cost of living relief measures, especially targeted towards working parents. These measures include increases to the paid parental leave, child care subsidy and affordable housing.

Cost of Living Relief

The buzzwords for the 2022/2023 budget were ‘cost of living relief’, with several initiatives announced in order to ease the pressures that are associated with the rapidly increasing cost of living caused by COVID-19, natural disasters and international pressures.

Personal Income Tax Rates

From 1 July 2024, there will be updates to the personal income tax rates. This will see the removal of the 37% tax bracket, and the 32.5% tax bracket being reduced to 30%. Additionally, the threshold for the 45% tax bracket will increase from $180,000 to $200,000. These income tax changes were legislated by the previous Government.

The new personal tax rates are set out in the table below:

| Taxable Income | Tax Rates from 1 July 2024 |

| Up to $18,200 | 0% |

| $18,201 – $45,000 | 19% |

| $45,001 – $200,000 | 30% |

| From $200,001 | 45% |

The new personal tax rates will not come into effect until 1 July 2024.

Low and Middle Income Tax Offset (LMITO)

Notably, the current Government did not announce an extension to the LMITO, which is scheduled to cease at the end of the 2022 financial year. However, an extension to the payment has not been ruled out and has been extended in the past.

Families, Health & Aged Care

Child Care Subsidy (CCS)

The Government has announced that it will provide $4.7 billion over four years from 2022/2023, and $1.7 billion per year ongoing in order to deliver cheaper childcare and ease the cost of living.

The proposed changes include:

- An increase in the maximum CCS rate from 85% to 90% for the first child in care.

- An increase to the CCS family income eligibility threshold to $530,000.

- An increase to the CCS rate for all of the families that earn less than the threshold.

Boosted Paid Parental Leave (PPL)

The government has also introduced reforms to the PPL scheme, investing $531.6 million over four years from 2022/2023 and $619.3 million per year ongoing.

The current Parental Leave Payment (18 weeks of paid leave for the primary carer) and the Dad & Partner Leave Payment (2 weeks of paid leave) will be combined under a new PPL Scheme which will allow eligible working families to access up to 20 weeks of leave that can be used in ways that suit their circumstances. Leave will be fully flexible and both parents can decide how to best split their 20 weeks of paid leave between themselves.

From 1 July 2024 – 1 July 2026, an expansion of the PPL scheme to 26 weeks will be phased in by adding two weeks to the PPL each year.

The income test will be broadened to a threshold of $350,000 in family household income (currently the income threshold of $151,350 applies to the mother only).

The PPL can be taken at any time within two years of the birth or adoption of the child.

An additional two weeks of PPL will also be made available to eligible single parents, meaning that they can now access the full 20 weeks that are available to couples.

COVID-19 Response Package – Aged Care

The Government has announced that an additional $2.5 billion over 4 years from 2022/2023 will be used in order to support reform in the aged care sector. The funding will ensure that all of the facilities have a registered nurse on duty 24 hours a day from 1 July 2023 and an increased care minutes per residency per day from 1 October 2024.

Housing

Affordable Housing

The Government also plans to build one million new houses within the next decade. The establishment of the $10 billion Housing Australia Future Fund has been announced, which will fund the delivery of 30,000 social and affordable homes. Furthermore, an initial $350 million in federal funding over five years from 2024/2025 in order to deliver an additional 10,000 affordable homes.

Aged Care

The new budget consists of $3.9 billion in aged care support and reforms. This includes the previous commitments of $2.5 billion for the increase in residential care staffing minutes and 24/7 nursing in residential aged care, plus an additional $1.4 billion for a range of measures including continued COVID-19 funding and implementation of an Aged Care Complaints Commissioner and Inspector-General of Aged Care.

Key Budget Measures

Some key measures for the additional $1.4b include:

- More than $840 million in additional funding for the Aged Care Support Program, including $35 million for ongoing onsite PCR testing in aged care

- Over $115 million for the supply of rapid antigen tests to service providers and care recipients in high-risk settings including residential aged care facilities

- Over $235 million to ensure PPE, treatments, rapid antigen tests and other supplies from the National Medical Stockpile for aged care, primary care, disability care and First Nations health services and frontline healthcare workers

- Funding to support any increases to award wages resulting from the Fair Work Commission decision following the Government submission for aged care workers

The Maggie Beer Foundation will be funded $5m to educate and train aged care staff to meet new nutritional standards.

Home care administration and management fees will be capped and exit fees will be abolished – ensuring the amount of funds going towards direct care is maximised.

The Albanese Government will mandate the number of care minutes residents receive – starting with 200 care minutes including 40 nursing minutes from 1 October 2023, and 215 care minutes including 44 nursing minutes from 1 October 2024. $2.5b will aid aged care homes in delivering more care minutes to residents. In addition, from 1 July 2023 all aged care homes must have a registered nurse on site 24/7.

Superannuation

From a superannuation perspective it has been a “quiet” Budget. However, there were some welcome announcements.

Please remember that the following budget announcements are not yet law.

Lowering the age for downsizer contributions from 60 to 55

The minimum age to make a downsizer contribution will reduce from 60 to 55. The maximum contribution, under these rules remains $300,000 per couple and all other rules remain the same.

The eligibility age is tested at the time the contribution is made to the super fund and not the time the house is sold (contract date).

This measure will take effect from the start of the first quarter after Royal Assent of the enabling legislation.

Relaxing residency requirements for SMSFs

As previously announced in the 2021/2022 Budget, the residency requirements applicable to SMSFs and small APRA funds were set to be relaxed through:

- the extension of the central management and control test “safe harbour” from two to five years, and

- the removal of the “active member” test – which would allow members who are temporarily absent from Australia to continue contributing to their SMSF.

These proposals had been slated to commence from 1 July 2022.

The Government has confirmed that these changes, broadly aimed at allowing greater flexibility for SMSF members who are temporarily overseas, are still set to go ahead. However, the start date for both measures has been deferred and will take effect on or after the date of Royal Assent of the enabling legislation.

Confirmation of proposals that will NOT go ahead

The Government has announced that the following superannuation measures will not proceed:

- the 2018-19 Budget measure that proposed changing the annual audit requirement for certain SMSFs to a three-year cycle

- the 2018-19 Budget measure that proposed introducing a requirement for retirement income product providers to report standardised metrics in product disclosure statements

Disability

The Labour government has committed to securing and repairing the National Disability Insurance Scheme (NDIS) over the next four years.

An additional $15.6 billion has been budgeted for Assistance to people with disabilities, of which $8.8 billion has been earmarked for the National Disability Insurance Scheme (NDIS). These revised spending estimates reflect the projected increases to participant numbers and increase in the average value of NDIS participant plans, as well as an increase in Disability Support Pension recipients.

Other funding announced for the sector include:

- $385 million in 2023–24 in additional funding to the National Disability Insurance Agency (NDIA) for operational funding to support NDIS participants, including employing an additional 380 permanent staff

- $126.3 million over 4 years from 2022-23 to establish a cross-agency Fraud Fusion Taskforce to address fraud and serious non-compliance in the NDIS. This taskforce replaces the existing NDIS Fraud Taskforce

- $33.6 million to establish an expert review pathway to resolve disputes arising from NDIA decisions, and support participants and families with their appeals

- $19.4 million to extend the Disability Employment Services (DES) program for 2 years

- $18.1 million over two years from 2022–23 to review the design, operation, and sustainability of the NDIS