25 March 2024 | Weekly Snapshot

Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 25 March 2024

Did you know?

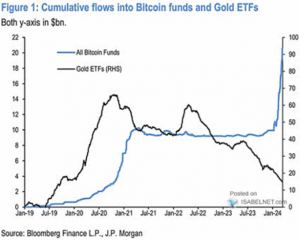

Since 2019, more money has flowed into Cryptocurrency funds than gold exchange traded funds. This proves that not all that is gold will glitter…

Market Movements

Australian Share Market (ASX 200) – up 1.3% this week.

Banks finished up between 1-2%, consolidating prices gains of approx. 15% since the new year. Strong economic data (unemployment rate falling to 3.7%) and stable interest rate have combined for a supportive backdrop. Resources were also stronger led by Woodside (up 4.0%) and BHP (up 3.3%).

Iron ore has declined 21% since 1-Jan-2024 (from US$140/ton to US$110/ton) whilst BHP shareholders are down only 10% during the same period, somewhat cushioned by the fact that BHP’s starting valuation point was modest.

Gold stocks were mixed (Northern Star down 2%, Newmont up 1%) despite a new all-time high in the gold price in both A$ and US$ (currently US$2,175/ounce). The diverging performance between the gold price and gold stocks demonstrates ongoing market concerns around broader cost-inflation pressures such as increasing labour costs.

A strong Australian employment market was noted thing week, with the unemployment rate falling from 4.1% (Feb-2024) to 3.7% (Mar-2024). In some ways, the strength of the labour market is unprecedented considering the pace and magnitude of interest rate rises from 0.10% in April-2022 to 4.35% (current).

U.S. Share Market (S&P 500) – up 1.9% and the Nasdaq also up 1.9%. The US share market (S&P500) set a new all-time high at 5,250 points.

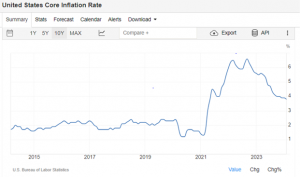

In the USA, monthly core inflation readings for January and February were both stronger than expected, annualising at approx. 4%, which is well above the 2% target from the US central bank.

After a strong earnings season, US tech stocks showed strong investor returns, as shown by the purple line in below chart (NASDAQ index). Investors are now seeing, arguably, quite elevated valuations across the tech sector. An opportunity we are monitoring is the ability for a ‘broadening’ of investor returns across the non-tech sectors. This opportunity has gained momentum recently, as per the below chart comparisons. The green line shows global ‘value’ shares, which represent companies who are predominantly in non-tech sectors, such as banks, resources and traditional industries. Compared to the purple tech index (Nasdaq), this green line has done a lot of catching up over the past week. This represents improved investor confidence in the relative value of non-tech shares as well as confidence in the ability for the broader economy to keep on keeping on.

Portfolio Movements

Amcor (AMC): CEO Ron Delia announced he will retire in a month’s time citing health issues. The company reaffirmed FY24 guidance for EPS in the 67 – 71 cps range with the current estimate of 68 cps at the bottom of this range. AMC is expecting to return to quarterly growth for the first time in 2 years. AMC has struggled to maintain earnings momentum faced with higher levels of customers ‘destocking’ in response to initial ‘overstocking’ during the earlier COVID waves. This issue (destocking) is now largely over according to AMC.

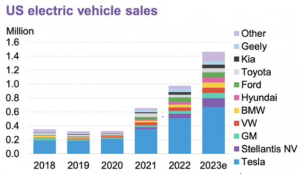

The competition is starting to catch up to Tesla (TLSA). Since 2017, Tesla has enjoyed US-market dominance for electric vehicle (EV) sales. However, we now see multiple competitors, who are collectively winning around 50% of the US EV market.

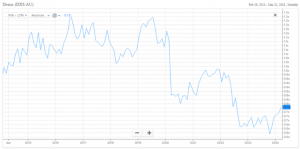

Our observation is that investor sentiment towards many of the Australian Listed Property stocks is quite negative. This can be seen by the below chart, which shows the price-to-book-ratio for Dexus (DXS), which is historically low at 0.7x. Low valuations are a good starting point for investors who might be considering new exposure. On the negative side, stubbornly high interest rates and work-from-home will continue to create challenges for lower quality, debt laden property exposures.

The Week Ahead

Wednesday, we get domestic inflation data. The market is expecting to see a 3.6% inflation rate (annual) for the February month, which is an uptick on the January reading of 3.4%.

Friday, we will see another important inflation reading in the USA. The market is expecting to see a monthly increase of 0.3% in core-personal-consumption-expenditures (or an annual rate of 3.6%). This is a decrease on the January month’s reading of 0.4%.

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.