Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 8 April 2024

Did you know?

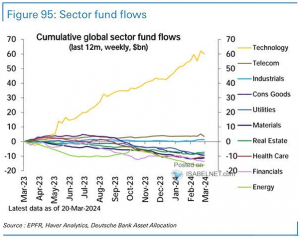

Over the past 12 months, the technology sector has represented basically all fund flows across the global equity sector basket with most sectors seeing outflows of investor funds over the same period. Quite amazing dispersion!

Market Movements

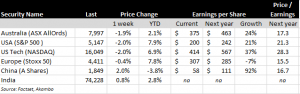

The Australian and US market were both lower by approx. 2% last week. In contrast, China (+2%) and India (+1%) were both higher. At the stock level in Australia, we saw growth names trade lower (CSL, Goodman Group) whilst the resources (South32 up 6.5%) were mostly stronger. At both levels, this demonstrates that investors are taking some profits in recent high performers and switching into the value/cyclical ends of the market. In the USA, we saw another strong jobs number on Friday night with 303,000 new jobs added to the economy (vs. 200,000 expected) and up from the previous month (270,000, February).

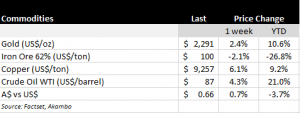

Gold and Copper continued higher. Iron ore remains the exception, which continues to retreat from very high levels. Chinese PMI data (Purchasing Managers Index) showed an expansion in manufacturing in March for the first time in 6 months, however the Steel PMI contracted at the fastest pace since May 2023. This could partly explain why BHP (basically flat) outperformed Fortescue (down 3.2%) for the week given Fortescue is more of a pure play on iron ore.

Supply is not helping iron ore prices with the ‘Simandou’ project (Guinea, Africa) expected to be in production during 2025. Simandou is a joint venture between Rio Tinto and Chinese-interests and has an annual production capacity of 60 million tons or approx. 2.5% of total global supply.

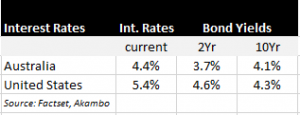

Yields on government bonds were higher over the past week. This is consistent with the above-mentioned switch from growth names into cyclicals. The US Secretary of Treasury (Janet Yellen) is currently in China, so interesting to see if geopolitics comes back into the financial picture.

Portfolio Movements

Amazon Grocery Stores: Ditching checkouts and installing ‘Dash Carts’

Amazon is removing its automated check-out systems from its Fresh supermarkets and instead will rely on ‘Dash Carts’. Dash carts will track and tally up items as customers shop. This allows customers to skip the checkout line.

Microsoft, OpenAI planning $100B supercomputer

Microsoft and OpenAI are planning to build a US$100B supercomputer and data centre project.

The scale of the investment highlights the competitive advantage that the large-scale tech companies hold. Microsoft has US$70B of cash and cash investments on their balance sheet.

Treasury Wine Estates (TWE)

China lifted the 175% tariffs over Australian wine last week, including TWE’s Penfolds range.

TWE is expected to lift prices as a result. Analysts expect a $100 million lift in TWE’s annual earnings by 2026 or approx 10% to earnings.

The Week Ahead

- Wednesday: CPI data in the USA: The market is expecting a month-on-month increase of 0.3%

- Wednesday: Minutes from the US Federal Reserve meeting. Investors will be looking for more clues around the expected path for interest rates.

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.