15 July 2024 | Weekly Snapshot

Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 15 July 2024

Did you know?

In 1984, after the attempted assassination, Reagan became a survivor and a hero in the eyes of the voters, which led to a landslide presidential victory.

Market Movements

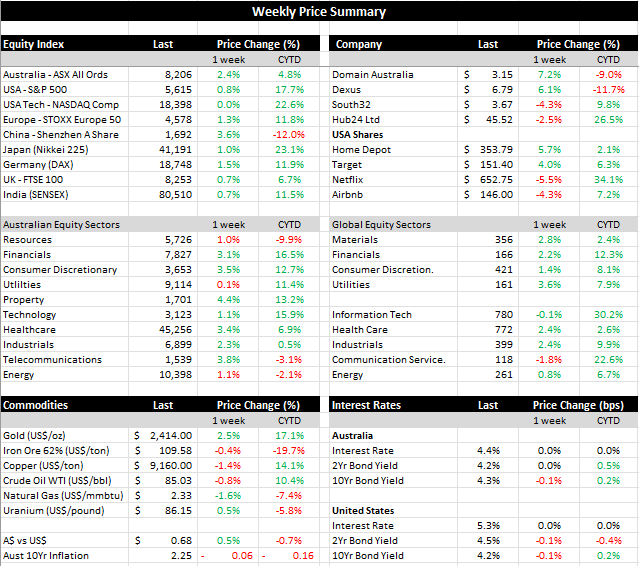

The Australian market traded higher by 1.7% last week, trading at all-time highs in the process. Consumer discretionary stocks were the strongest (up 3.8%) led by JB Hi-Fi (up 6.4%). Resources were the worst performers (down 0.7%) including BHP which was down 2.7%. Domain Australia was one of the strongest performers (up 7.2%) with no news.

In the USA, the S&P500 was stronger by 0.9% led by the utilities sector (up 3.4%). Communication services were the weakest sector (down 2.6%). Target was one of the stronger performers, up 4%, reflecting confidence in the US consumer sector ahead. Airbnb and Netflix were both down approx. 5%, reflecting some profit taking. The US added approx. 200k new jobs in June, which was broadly in line with expectations and consistent with a healthy labour market. Thursday night was a big night in the USA with the release of the inflation data, which showed inflation declining 0.1% month-on-month. This is the first decline since Jun-2020 so is symbolic in that the higher interest rates are doing the job. As a result, bond yields fell, defensive stocks (utilities) rallied, and market expectations grew for between 2-3 interest rate cuts before the year is out. Interestingly, large US tech stocks fell 2% whilst the broader market rallied, a big reversal on recent trends this year. This is in stark contrast to Australia, where expectations are for interest rate rises for the remainder of 2024.

Trump’s attempted assassination shouldn’t be left out, noting that his election odds have improved significantly. Thus, markets could continue to ‘price in’ the outcomes of a successful Trump campaign, which could include reducing the corporate tax rate from 21% to 20% and further US protectionism e.g. extending China tariffs.

The US market is currently trading on a price-to-earnings ratio of 21.6x with a backdrop of rising earnings expectations.

Portfolio Movements

Telstra increases prices on mobile plans

- Telstra announced it would be making changes to its mobile plans that will see prices increase by between $2-$4 per month.

- Telstra noted the cost-of-living pressures, but also its need to continue to invest in its mobile network.

- Telstra shares rose 3% to $3.81 last week

Reports that Google is looking to acquire Wiz

- Reports that Google is in advanced talks to acquire cybersecurity firm Wiz for $23 billion. If reports are true, this would be Google’s largest ever acquisition.

- Wiz was founded in 2020 in Israel.

- What does Wiz do? Wiz’s cloud security gives their customers insight into a company’s full cloud presence, something appealing to large firms with significant computing resources.

- Neither Wiz or Google responded to requests for comments according the Wall Street Journal report.

Dassault Systemes guides for lower Q2 revenue

- French software solutions and consulting services company Dassault Systemes provided guidance with revenue below but earnings in line with Q2 objectives.

- Total revenue is now estimated at €1.495 billion in Q2, or annual growth of approximatively 4%, versus previous guidance in the range of €1.525 to €1.555 billion. EPS estimated at €0.30 is in line with guidance of €0.30 to €0.31.

- Revenue shortfall is due to large transaction delays. “Importantly, all deals that have been delayed are still in our roadmap for future quarters. However, we anticipate that a certain volatility in customers’ decision-making will continue and consequently believe it is prudent to reflect this in our full year outlook.” said CEO Pascal Daloz.

The Week Ahead

- Monday: Goldman Sachs will report Q2 earnings, where expectations are for earnings of $8.35/share.

- Tuesday: Retail sales in USA, expecting a flat reading of 0%, down from 0.1% in May. Bank of America will report Q2 earnings, where expectations are for $0.80/share.

- Wednesday: Johnson and Johnson report earnings with expectations of $2.71/share, down from $2.80 same time last year.

- Thursday: Australia’s unemployment rate, which is expected to be flat at 4.0%. In the US, initial jobless claims will be reported, where markets are expecting 235k jobless claims, which is a slight increase on the May results (222k).

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.