Super Update – Preparing for 30 June and Pending Changes

As we approach the end of one financial year and the beginning of another, now is the time to review the options available to you for any additional contributions you may want to make prior to 30 June 2024.

It is also an appropriate time to review the implications of the new rates and thresholds that apply from 1 July 2024 to ensure that you adjust your salary sacrifice arrangements to account for the additional super guarantee that will be paid by your employer in 2025.

If you are planning to make additional contributions in 2024, they need to be received into your super fund well before 30 June 2024, which falls on a Sunday this year.

See the below summary of rates and thresholds and if you have any queries, please don’t hesitate to contact us.

Summary of Rates and Thresholds

Stage 3 Tax Cuts and Implications

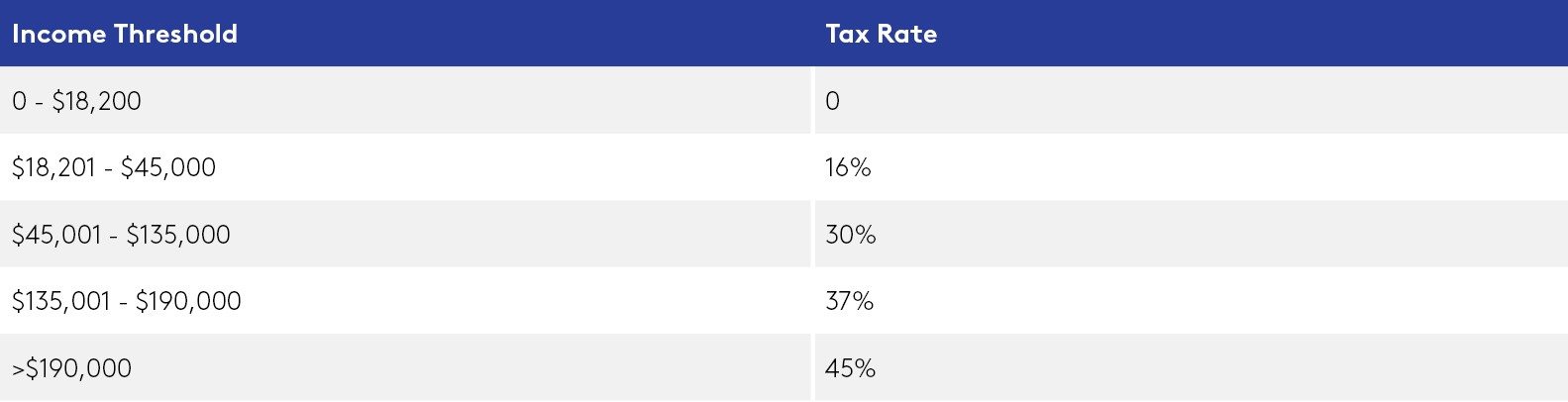

From 1 July 2024 the tax thresholds and tax rates (excluding the 2% Medicare levy) will be:

As the tax rate paid on super contributions is 15% the tax effectiveness of additional superannuation contributions for those earning between $18,200 and $45,000 is reduced in the 2025 year.

It may be more tax effective to make additional superannuation contributions before the 30 June 2024 while the individual tax rate is still 19%.

Victorian Land Tax and Stamp Duty changes that may impact your SMSF

Commercial and Industrial Property Tax (CIPT)

From 1 July 2024, land transfer duty (stamp duty) on commercial and industrial properties will be abolished and replaced with an annual property tax (CIPT).

After 1 July 2024, commercial and industrial properties will transition to the new scheme as they are sold, with property owners being required to pay an annual tax, based on 1% of the property’s site value, commencing 10 years after the transaction.

The annual property tax for commercial and industrial property will be 1 per cent of the property’s unimproved land value. See the Information Sheet.

Land Tax Surcharge

As part of the 2023-24 State Budget a new COVID-19 debt temporary land tax surcharge will apply in addition to the existing land tax. This will apply from the 2024 land tax year for ten years.

The general rates which apply to land owned by individuals, companies and SMSFs is shown below:

Valuing Investments in your SMSF

Asset valuation is a key component of preparing meaningful SMSF financial reports. The investment values adopted will directly impact the rate of return achieved and each member’s total superannuation balance.

Reporting fund investments at market value on an annual basis is required to confirm that your SMSF has complied with relevant super law for:

- preparing the financial statements of the fund

- determining an individual’s total super balance

- acquiring assets from related parties

- ensuring that investments are made and maintained on an arm’s length basis

- determining the account value for super pensions

- determining the amount counted towards an individual’s transfer balance cap when a pension commences.

Given the impact that asset valuations have the Australian Taxation Office has issued valuation guidelines for trustees to follow. These guidelines set out the type and timing of valuations required for certain events as well as specific requirements for different asset classes. If the guidelines are followed the Taxation Office has stated that they will generally accept the valuation.

Valuations for the Annual Financial Statements

For SMSF annual financial statements ALL assets must be accounted for at market value and that value must be based on objective and supportable data. Generally anyone can undertake a valuation if it is carried out on this basis, however, the use of a qualified independent valuer should be considered if either:

- an asset represents a significant proportion of the fund’s value

- the nature of the asset indicates that the valuation is likely to be complex.

The value of cash, term deposits, listed investments and managed funds is readily available but direct property and unlisted investments pose a greater challenge.

Direct Property

The Taxation Office have stated that an external valuation is not required each year, however a recent valuation would be prudent if there has been a significant event that may have affected the value. A significant event could be a change in market conditions due to a pandemic, a natural disaster such as a bush fire or flood or major improvements to the property.

If the trustees choose to value the property themselves the following relevant factors may be considered:

- the value of similar properties

- the amount that was paid for the property when purchased from an unrelated party

- independent appraisals

- rates valuations

- whether the property has undergone improvements since last valued

- for commercial properties, net income yields.

The fund’s auditor will expect to see signed documentation detailing how the value was arrived at, including copies of all the objective and supportable data to back up the value included in the financial statements.

Unlisted Securities and Trusts

Trustees have certain duties and responsibilities designed to protect and increase a member’s benefits for retirement. It is expected that trustees will be aware of the value of an asset at the time of acquisition and have an understanding of its potential for capital growth and capacity to produce income.

When valuing an unlisted security such as a share in a private company or a unit in an unlisted trust for the annual financial statements, the Taxation Office expects trustees to take into account both of the following factors:

- the value of the assets owned in the private company or unlisted trust

- the consideration paid on acquisition

They also suggest that it may be wise to use an external valuer if the valuation is complex.

The other relevant factors that Trustees should consider for valuing unlisted investments are:

- the price paid for shares or units that have changed hands in the last 12 months

- the price and explanations provided by the financial officer of the unlisted company or trust

- the net asset value as shown in the entities’ financial statements where market value reporting is used

- the detailed valuation based on maintainable earnings

As with property valuations, Trustees need to base their valuation on objective and supportable data, document this clearly and provide evidence for their auditor to see.

The full Taxation Office guidelines can be found at here.

If we can assist with the documentation requirements, please contact us.

Progress of Pending Legislation:

Proposed tax on Super Balances over $3m (Division 296 tax)

A Senate Committee reported back on 10 May with a majority recommendation to pass this tax without alteration. There was no mention of this new tax during the recent Federal Budget other than to set aside funds to help implement if for members of the Commonwealth defined benefit schemes.

The Greens have mounted another effort to have the Government take even more drastic action, but we are no closer to seeing the legislation passed at the time of writing.

The Government hopes to have this passed prior to 30 June so that individuals have a full year to prepare for the start date on 1 July 2025.

See the November Super Update for full details of how this new tax works.