Stage 3 Income Tax Cuts

The Labor Government has announced changes to the ‘Stage 3’ income tax cuts introduced by the Morrison Government. The previously legislated tax cuts removed the 37% tax bracket for individuals earning between $120,001 to $180,000, and increased the threshold from where the top marginal tax rate applies to $200,000. This proposal had the effect of flattening the marginal tax rate to 30% for those earning between $45,001 to $200,000.

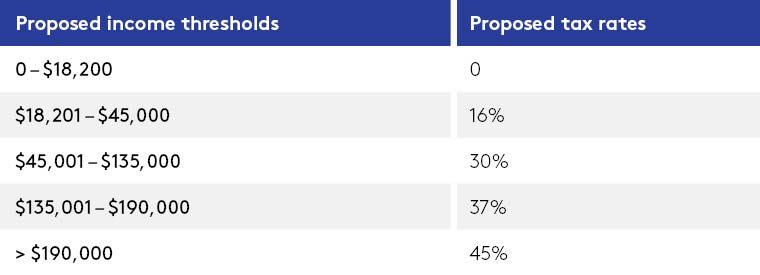

However, the Labor Government has proposed the following changes from 1 July 2024:

- Reducing the 19% tax rate to 16% for incomes between $18,200 and $45,000.

- Reducing the 32.5% tax rate to 30% for incomes between $45,001 to a new $135,000 threshold

- Increasing the threshold at which the 37% tax rate applies from $120,000 to $135,000.

- Increasing the threshold at which the 45% tax rate applies from $180,000 to $190,000.

The proposed changes to thresholds and rates (excluding the 2% Medicare levy) are as follows:

The proposed changes give rise to tax planning opportunities. One example is the timing of concessional (tax-deductible) superannuation contributions. With the proposed tax rate for those earning between $18,200 and $45,000 dropping from 19% to 16%, the tax effectiveness associated with extra concessional superannuation contributions reduces. As a result of this, it could be more tax effective for you to make an additional superannuation contribution before 30 June 2024.

Salary Packaging

The proposed changes will affect some employees who have salary packaging arrangements with not for profit (NFP) organisations, but this will depend on their employer’s status for fringe benefits tax (FBT) purposes. If you work for an NFP organisation that is a ‘rebatable’ FBT employer then from 1 July 2024 you should only package ordinary benefits (such as expense payments) if your taxable income is greater than $135,000. This is because the effective FBT rate will be less than the marginal tax rate that applies to income above this threshold.

If you have any questions or concerns about these changes, please do not hesitate to contact us, or view the changes on the Taxation Office website.