13 May 2024 | Weekly Snapshot

Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 13 May 2024

Did you know?

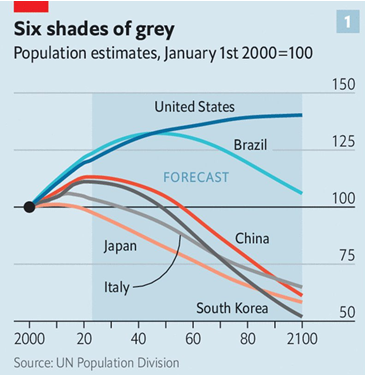

The population of China has likely peaked this decade. This will create an interesting outlook in terms of an aging population and house construction. The population in the USA will continue to grow as a main beneficiary of immigration.

Market Movements

The Australian market rose 1.6% this week.

The Energy Sector was the strong point (up 4.3%, Woodside up 5.0%). Australia’s Federal Labour minister released a new Future Gas Strategy, which locks in gas demand beyond 2050. The minister said it will be “based on facts and data, not ideology or wishful thinking” in what looked like pushback against the more radical green elements of the party. The strategy highlighted that gas must remain affordable and that new sources of supply are needed.

Consumer stocks were the weakest after a disappointing sales update from JB HiFi, which showed flat quarterly sales for the quarter ending March. JBH shares fell 6.7% this week.

The RBA kept the cash rate steady at 4.35% as expected and the ASX surged on the news.

The US markets was higher by 1.9%.

Shares were supported after Federal-Reserve-Chair-Powell kept interest rates unchanged but maintained an easing bias in saying, “it is unlikely the next move in rates would be up.”

US jobs data moderated somewhat after some extremely strong data points earlier in the year. The US added 175,000 new jobs in April (200k is considered a strong number) and below the 235,000 expected. In addition, initial unemployment claims rose to 231,000, which is the highest since August-23. All the same, the unemployment level remains near record lows at 3.9%.

Looking at valuations, the forward 12-month price-to-earnings ratio for the S&P 500 is at 19.9x, which is on the high side historically. The equal weighted index, however, is trading at 16.4x (blue line in bottom half of chart below), which is pretty normal for a backdrop of earnings growth (earnings are shown in the green line in the top half of chart). The equal weight index is a broader measure of market health because it removes the skewness from the large-tech companies (like Amazon and Microsoft), which dominate the large cap end of the market.

Portfolio Movements

CBA results for 3Q, Profits down 5% from the same time last year.

- A similar story emerged across all the reporting banks this week with profits down (slightly), lower impairments and increased dividends or buybacks.

- CBA’s net profit was $2.4B, slightly ahead of the $2.36B expected, but down 5% on Q3 last year.

- Operating expenses up 2% for the quarter, with higher amortisation and staff costs partly offset by productivity initiatives.

- CEO Matt Comyn said “The fundamentals of the Australian economy remain sound. Unemployment remains low, supported by business and government investment and elevated terms of trade. We recognise that all households are feeling the impact of higher inflation and higher rates, however immigration is providing a structural tailwind for the economy.”

- CBA shares were up 1.8% this week

ANZ Half-year results, shares finish up 2.2% for the week.

- ANZ reported 1H earnings with similar themes to NAB, Westpac and CBA. Earnings are down but balance sheets are in good shape allowing for increased dividends and buybacks.

- ANZ reported a 4% fall in interim cash profit to $3.55B largely in line with the $3.54B expected. Net interest margin of 1.63% is down but a slight beat on the 1.62% expected.

- ANZ boosted its dividend by 2.5% and plans to buy back up to AU$2 billion of shares on-market with impairment charges falling to just $70M, well below the $285.5M charge expected.

- CEO Shayne Elliott said “The Australian and New Zealand economies are likely to remain subdued, while geopolitical tensions, electoral uncertainty and the introduction of interventionist trade and industry policies will continue internationally,”

- ANZ shares finished up 2.2% this week.

Orica half-year results, shares finished up 3.3% for the week.

- Global explosives and chemicals company Orica reported first-half results with underlying profits of $179M, which was ahead of the $174.8M estimate.

- In interim dividend of 19 cents was declared, a 1 cent increase on last year.

- Orica shares finished up 3.3% for the week

Nippon Steel, Full Year Results, shares down 6.6% for the week.

- Nippon Steel, the Japanese steelmaker, released full year results; revenue of 8.8 trillion yen (US$56.43 billion), up 11.2% from the previous year. Net profit fell 20.8% to 549 billion yen but still ahead of guidance for 464.6 billion Yen.

- Looking ahead, Nippon’s revenue guidance is for a flat result on FY24.

- Shares down 6.6% for the week

The Week Ahead

- Tuesday: The Australian Federal Budget (2024-24) will be released. Their focus will be on cost-of-living assistance, including the already confirmed stage 3 tax cuts, which will come into effect on 1-July, providing some income tax relief for people earnings less than $190,000. Australians can expect budget support for childcare, welfare, defence spending and students. What will this mean for our investment portfolio? Probably not a lot from a stock specific standpoint, but from a top-down point of view, if total spending is large enough, it will, at the margin, support inflation.

- Wednesday: Consumer Price Index in the USA. The month-on-month reading is expected at 0.3%, which annualises at 3.6%. The previous month 0.4% for the month. We also get retail sales for the USA, where figures have been going strong. Expectations for a 0.4% monthly increase.

- Thursday: In Australia we get jobs data, where the unemployment rate is expected to increase from 3.8% to 3.9%

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.