22 July 2024 | Weekly Snapshot

Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 22 July 2024

Did you know?

The below chart shows the recent jobs growth in Australia. It shows that recent employment growth can be entirely attributed to the public sector. Firstly, our public finances are in great shape, so there isn’t an impending risk due to draining government finances. Secondly, the jobs growth is very narrow and the visual slowdown in the private sector could soon become a source of job losses.

If anyone is interested, there is a well-paid job available as the head of the Victorian CFMEU.

Market Movements

The ASX rose 0.9% this week. A negative 0.1% inflation reading in the USA last week sent bond yields somewhat lower and this boosted shares in the listed property sector (up 4%) and healthcare stocks (up 2.6%) in particular. James Hardie was among the strongest stocks (up 9.6%), which will also benefit from lower bond yields as it relates to nearer-term momentum in the US building sector. Australia’s June employment data showed a 50.2K jobs increase, double the 20K expected, but the unemployment rate rose from 4% to 4.1% due to higher participation rates. If working for the CFMEU is not your thing, CrowdStrike could be looking for a new CEO this week, after a failed IT update halted operations across banks, airports and supermarkets across the globe on Friday.

It was a big week in the USA, which ended down 1.4%. A failed attempted assassination boosted trump’s elections odds. Trump will support lower taxes and a stronger Chinese currency (or weaker US$). Both good for equities and gold. US inflation showed the first decline in many years and markets are now expecting 2 interest rate cuts this year, also great for markets. This triggered a rotation into US small caps and out of large US tech stocks. This could in part be explained by the valuation starting point, whereby small stocks are relatively cheaper vs. large stocks compared to previous years.

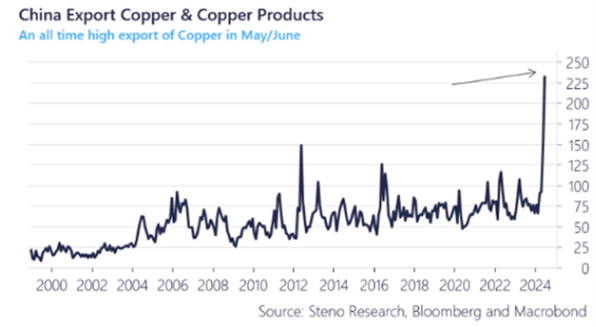

In China, GDP growth slowed to 5.0% for the year, from 5.3% in Q1 and below the 5.1% growth expected. New home prices in China were down for the 12th straight month in June falling another 0.7%. The weak data reinforced calls for additional policy support. An interesting chart below shows China copper exports, which historically has been low due to strong internal consumption. Recent internal weakness however has led to an escalation in copper exports. This suggests that copper prices are presently more so reliant on ex China demand than they have been for years.

Portfolio Movements

Santos reports solid Q2 production and cash flow

- Santos provided a Q2 update yesterday with revenue of US$1.3 billion and production of 22.2 million barrels of oil equivalent

- The Barossa Gas Project now 77% complete.

- Santos CEO Kevin Gallagher said, “First half cash flow of almost US$1.1 billion positions us well to fund shareholder returns, backfill and sustain our existing business, and grow our Santos Energy Solutions business”.

ASML beats Q2 estimates but lowers Q3 guidance. Shares fall

- Semiconductor producer ASML Holdings reported Q2 EPS of €4.01, a decent beat on the €3.73 estimate. Q3 guidance for net sales of €6.7B-€7.3B was below the €7.62B consensus, although the FY24 outlook was unchanged.

- CEO Christophe Fouquet said “Our outlook for the full year 2024 remains unchanged. We see 2024 as a transition year with continued investments in both capacity ramp and technology. We currently see strong developments in AI, driving most of the industry recovery and growth, ahead of other market segments”

J & J beats Q2 estimates – Shares rise

- Health giant Johnson and Johnson reported better than expected Q2 results with EPS of $2.82 ahead of the $2.70 expected. Revenue of $22.4 billion was also a slight beat on the $22.3 billion expected.

- Results were boosted by strong sales of its drugs, including cancer treatment Darzalex, where sales rose 18.4% to $2.88 billion.

- CEO Wolk said on a post-earnings conference call that sales growth for the company’s pharmaceuticals business will be lower in the second half of this year as Stelara biosimilars enter the Europe market later this month.

The Week Ahead

- Monday: Verizon reports Q2 earnings, expectations of $1.15/share, down from $1.21 same time last year

- Tuesday: Alphabet reports Q2 earnings of $1.83/share ($1.44/share same time last year) and Tesla will report earnings, with expectations of $0.61/share for Q2 ($0.91 same time last year). Large US tech stocks, overall, have had a great run. If earnings disappoint, it might lead to a short-term retracement.

- Wednesday: Global manufacturing PMI, expecting an expansionary reading of 51.5 (May was 51.6)

- Friday: USA, core personal consumption expenditures price index (CPE, the Federal reserves preferred inflation reading) is expected to show a month-on-month increase of 0.2% (May 0.1%)

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.