Victorian Portable Long service leave for community services

By now most Victorian employers in the community services sector will be aware that the Portable Long Service Leave Scheme (the scheme), governed by the Portable Long Service Leave Authority (PLSA) has been expanded to include employees in the community service sector. This includes activities funded under the NDIS and services provided by licensed children’s services.

The assessment of “Who is a community services employer?” is a broad assessment which can include varying employees who are providing services to the community. The PLSA has released the following guidance in regards to the employees covered by the scheme:

https://www.vic.gov.au/guidance-note-1-applying-predominance-test-community-services

Some key facts about the scheme:

- The scheme applies to all employees who are classified as community service workers under the test – full time, part time and casual staff are all required to be part of the scheme.

- Community services employees are required to be a part of the scheme starting 1 July 2019. Starting 1 January 2020 NDIS and children’s services employees are also required to be part of the scheme.

- Unlike portable long service leave for contract cleaning and security staff, there is no recognition of prior service for community services staff before 1 January 2020.

- The PLSA will only reimburse employees for the period of time that they have been registered in the scheme. For example, if the worker has worked for the employer for 10 years, but only has 6 months recorded with the Authority, the Authority will only reimburse the employer for the leave associated with that 6 months of service. The employer will be liable to pay the balance.

- Employers will not be reimbursed for payments to the scheme, this includes after an employee leaves the organisation, even if the employee is exiting from the community services sector.

- Employees can choose to have their entitlement paid by their employer or the Authority. If they choose to be paid by their employer, the employer can then seek reimbursement from the Authority. However, reimbursements from the PLSA will not include superannuation, payroll tax or other on costs.

- Unlike contract cleaning and security, the community services scheme is a cash only benefit with no leave requirement attached to it.

- There is currently some uncertainty around employers who are employing community services staff under an award which is more generous than the statutory long serve leave requirements. Based on our understanding and our conversations with the PLSA, the authority will reimburse an employer at the higher rate if staff are employed on a fair work instrument.

How do I account for this? – The simplified version

Example:

- Johnny works as a support worker in a registered NDIS provider. His employer has registered him to be part of the scheme. At 31 December 2020 he has been employed for 4 years with his current employer.

- Johnny’s long service leave liability with the employer is frozen at 3 years’ worth of hours (since the scheme started on 1 January 2020 for community service workers);

- At 31 December 2020 the employer has made 12 months’ worth of contributions to the scheme;

- Johnny’s EBA states that his LSL rate is 0.866 per year (13 weeks over 15 years).

Accounting treatment:

Long Service leave liability – the number of hours accrued will freeze at 31 December 2019. However if Johnny has an increase in wage rate every year, the liability will need to reflect this.

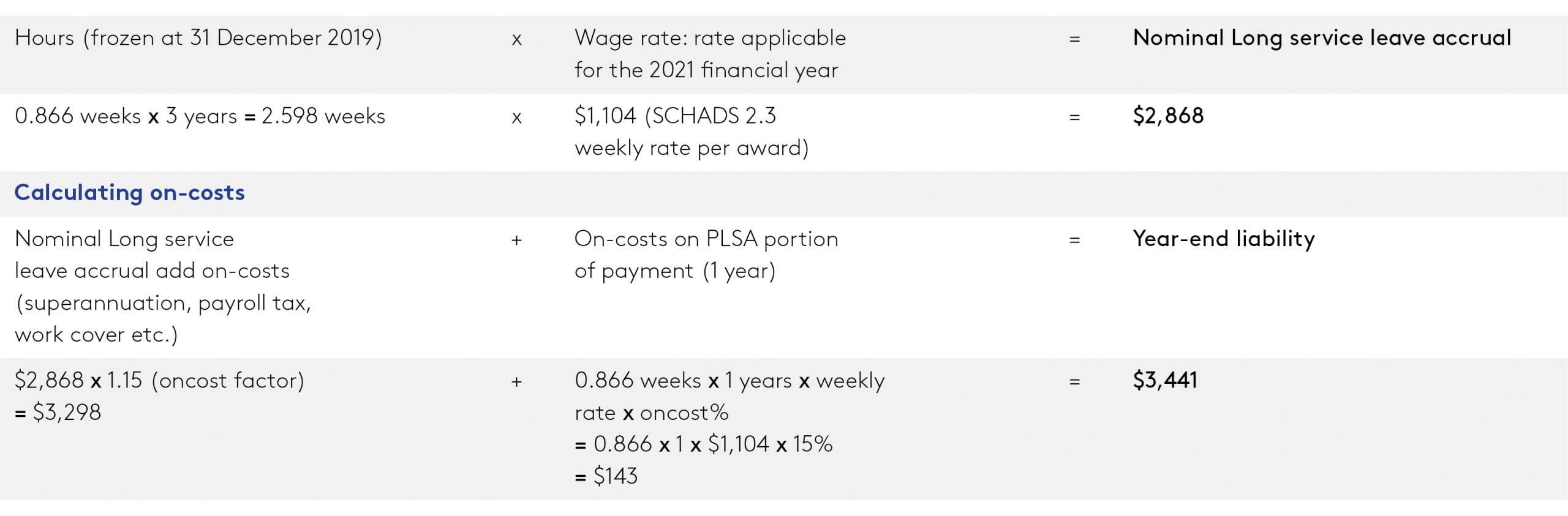

Calculating the liability for 31 December 2020:

Journals:

DR: LSL Expense: $3,441

CR: LSL Liability: $3,441

Note: if your organisation complies with AASB 119 (i.e. for general purpose financial statements) the liability will need to be discounted and probability weighted in accordance with the standard.

Payments to the scheme – these will be expensed as they are paid.

DR: LSL Expense (or payroll expense)

CR: Bank

Using the Benefits:

Taking leave

Assume that Johnny reaches 7 years of employment with his current employer. Johnny now wants to take a well-deserved holiday he can take his long service leave which will be funded:

- 3 years by his employer; and

- 4 years by the scheme.

Johnny would apply for his time off, partially paid LSL and partially unpaid leave. The employer will be required to pay Superannuation on the entire amount of leave if the employee elects to have the entitlement paid by the employer.

What if he leaves at 7 years?

Assuming that Johnny works for 7 years exactly and resigns, what would happen to his leave balance?

Johnny’s long service leave payout would be made of:

- 3 years by his employer; and

- 4 years by the scheme.

The employer would then put a claim into the authority to claim 4 years’ worth of levy contributions.

What if Johnny leaves earlier?

Let’s assume that Johnny leaves after 5 years of employment. He would not be paid out from his employer. And the employer would write back the provision down to nil.

Furthermore, Johnny would need to work in the sector for 7 years (from 1 Jan 2020) in order to be eligible for a payout by the scheme.

What about super? – Super is the responsibility of the employer. The scheme will not pay superannuation.

Actions Required:

- As an employer, consider if your employees may be covered under the scheme. This may require further advice from a professional;

- Consider the impact of the act on your cashflow and budgeting forecasts; and

- Consider the impact on the calculation of the long service leave accrual balance at year end.